Saving 101

The term saving refers to money set aside for future use. Savings generally represent only one part of an individual’s assets, and unlike investments, usually have minimal exposure to risk and are more readily accessible.

Saving could also be described as the act of creating, maintaining and increasing the value of assets or income over a period of time – it helps us achieve financial goals

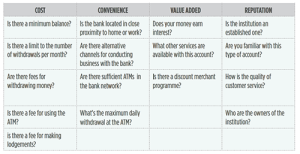

Practical considerations when selecting a Financial Institution and Saving Products

After you have selected the right institution, the next step is to decide on the most suitable type of account. Here are some options:

Regular Savings – A deposit account which provides principal security and a modest interest rate

Contractual – Interest bearing account in which you regularly deposit a fixed sum of money for an agreed period

Fixed Deposit – Interest bearing an account in which a fixed sum is deposited for a specific period with the option to roll over at maturity

– The interest rate is usually higher than a regular savings account

Advantages of Saving with an approved financial institution

- Your money is safe

- The institution pays you interest

- You gain access to other financial services

- You are contributing to the development of the economy

Advice for saving:

- Pay yourself first – Save 10 percent of your income

- Design and maintain a budget, the best tool for saving

- Take advantage of sales and discounts

- Do not spend on unbudgeted items

- Make a list before going shopping and do not buy anything not on the list

- Create an Emergency Fund

Create a financial cushion consisting of 3-6 months living expenses. This will enable you to take care of unforeseen expenses using cash you have saved instead of getting into debt. Whenever you have used up some of these funds, replace it so you are ready for the next emergency. Since emergencies can occur at any time it is strongly recommended that this fund be established before other forms of savings

Note: Money in the Emergency Fund should not be used to take care of periodic expenses which are not emergencies, such as school fees and car insurance; these should be budgeted for monthly.

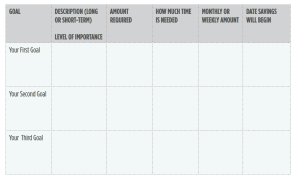

Goal Setting – set short, medium and long term goals. This will help you save towards them and ultimately achieve financial independence.

Check out more stories like this

Leadership Transition at JN Bank

A Statement from Hon. Earl Jarrett, OJ Deputy Chairman and...

JN Supporting MSME Recovery from Melissa

Micro and small businesses devasted by Hurricane Melissa are set...

Renting a Property? Five Reasons to Get a Signed Rental Agreement

You found a nice home in a great location, and...