Card skimming is not new. Over the years it has affected several deposit taking institutions and continues to be a challenge in Jamaica and many countries around the world

Recently, some of our members in Morant Bay, St Thomas were victims of card skimming. Their debit cards were cloned either at an ATM or while carrying out a transaction via a point-of-sale machine, which criminals used to make withdrawals on their accounts. Thankfully, the members were alerted to the activities via our text and email alert set up for all debit and credit cardholders and quickly made a report to us. Those affected members’ cases were speedily investigated and we immediately returned the sums stolen from their accounts.

In light of this incident, we take this opportunity to further remind you about the dangers of card skimming, also known as card cloning, and how to avoid it.

What is ATM or card skimming?

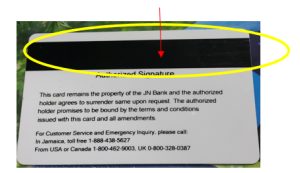

ATM skimming is a type of fraud which occurs when criminals capture data from the magnetic stripe on the back of an ATM card. It involves the installation of a device, usually undetectable by unsuspecting ATM users, that secretly records the customer’s card details when the ATM card is inserted into the machine.

Criminals can then encode the stolen card details, create a counterfeit copy card and use the card to steal from the customer’s bank account linked to that ATM card. ATM skimming is a world-wide problem.

Types of skimming devices

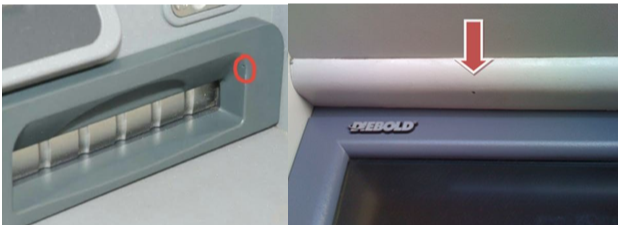

Scammers have designed their skimming devices to look exactly like the ATM, which makes it difficult for customers to notice that something is attached to the ATM. See images below.

This deep insert skimmer is as thin as a credit card and invisible from the outside of the ATM.

What is PIN capturing?

PIN (your personal identification number) capturing involves strategically installing cameras or imaging devices onto the ATM or inside the building hosting the ATM, which fraudulently record or capture the customer’s input of their PIN.

Skimming devices are becoming more sophisticated and so instead of a camera, the scammers may use an overlay. That is, a fake keypad fitted over the real keypad. When you press a button on the fake keypad, it records the button you pressed and presses the real button underneath. These are harder to detect and unlike a camera, they are guaranteed to capture your PIN.

Once captured, the counterfeit card and PIN are used to withdraw money from the customer’s bank account.

Here are five tips to help you avoid being a victim of card skimming:

- When using your card, do a thorough scan of your environment.

Before using any ATM, check carefully. Look for glue stains or any unusual markings around the area where the card is inserted (card reader) and the keypad. If the numbers on the keypad are hard to press or feel thick, a false keypad was possibly installed. You should try to move the parts with your hand to check if they are loose. Also, look around carefully for any hidden cameras inside the facility.

- Protect your card and PIN.

When entering your PIN at the ATM or at a POS machine, cover the keypad with your free hand to shield your activity from prying eyes or cameras that may be recording your number.

- Never let your card out of your sight.

Never allow your card to leave your sight while making purchases via POS machine. Often, hackers steal information from the places you trust, such as gas stations and restaurants.

- Stay in public view.

Machines in public view with security monitoring, such as those inside the bank, are less likely to be tampered with. Use these for additional protection, but still be alert when using them.

- Pay attention to text and email alerts.

Alerts help you to easily monitor your account activities. Several financial institutions offer this option to their customers. Ensure you pay keen attention to these alerts and make queries immediately by calling or visiting your bank, whichever is most practical and convenient. You should ensure all your banks have your contact information, especially your cellphone number and email address. If you believe they do not, contact them immediately to update. You may reach our JN Member Care Centre at 888-991-4065/6 24/7, including weekends and public holidays.

- Trust your instincts.

Above everything else, ‘trust your gut’. If you suspect foul play or feel uncomfortable for any reason, use another ATM or payment method. Check your accounts regularly also, so you can detect any fraudulent activity quickly and report it your bank.

Remember, if you suspect there has been any unauthorised activity on your account, immediately visit your nearest JN Bank branch or call our Member Care Centre at:

- 888-991-4065 or 876-906-5343 (Jamaica)

- 1-800-462-9003 (USA/Canada)

- 0800-328-0387 (UK)